A few weeks ago Jean Chatzky created a bit of a storm on Twitter when she tweeted out the Fidelity guidelines for how much to have saved by what age. I was actually surprised that it was so controversial, given that Fidelity has had these same guidelines out for a few years now. I guess people pay more attention when somethings on Twitter than when a financial company publishes it on their website?

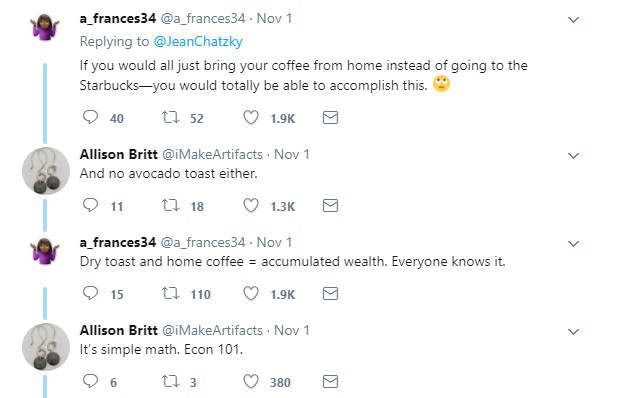

Of course, most of those 1600 comments were people complaining about why they don’t like this rule of thumb, why it doesn’t apply to them, and making fun of people who do try to hit these benchmarks by doing such outrageous things like making coffee at home and not spending $20 on avocado toast.

Although my friend Guy on Fire will somehow will achieve retirement while buying avocado toast. Which we all know is impossible, so he must have a trust fund somewhere.

This got me thinking about overall financial rules of thumb. Are they good thing? Bad? Only good if you’re going to hit them, but bad if you don’t?

Financial Rules Of Thumb

We’ve all seen them around the internet, and in financial books. They’re the guidelines and rules that tell you whether or not you’re financially on track. I can rattle a bunch of them off the top of my head (why yes, I am a personal finance nerd. Why to you ask?):

- Dr. Thomas Stanley’s Millionaire Next Door formula for Prodigious Accumulators of Wealth (PAW) and Under accumulators of Wealth (UAW):

- PAW-Net worth is more than twice the product of their age and one tenth of his/her realized pretax income (2* Age * (Income*0.1)).

- UAW -Net worth is less than than half product of their age and one tenth of his/her realized pretax income (0.5* Age x (Income*0.1)).

I used to be frustrated at this formula because I first read The Millionaire Next Door in my 20’s. Frankly it just doesn’t work at that age. I didn’t know that the doctor had actually wrote more about how to (and how not to) use this formula in his article How Wealthy Should You Be until I was researching this article right now. He says:

“So what if you didn’t start working until you completed an advanced degree, served in the military or were disabled? In such cases, you need to deduct those years from your current age when using the Wealth Equation. Again, if you haven’t reached your 50s, the Wealth Equation is likely to overstate what you should actually be worth.”

- Fidelity’s new college savings rule of thumb, stating you should have saved “$2,000 * age of child” as a guideline to paying for half the cost of an in-state, public school

- Ah but their old rule of thumb was much more complex. Launched in 2010, it varied by income level, and public vs. private. For a public institution, you would save about 3% of your salary per child every year from when they were born. Private ranged from 5.5-9%, with lower percentages at higher income levels

What about for retirement?

- Fidelity recommends aiming to save at least 1x your income at 30, 3x at 40, 7x at 55, 10x at 67.

- Although they used to recommend 1 times salary at age 35, then 2 times at 40, 3 times at 45, at 60, you should have 6 times your salary at that age set side, then finally 8 times by age 67

- Multiply your needed annual expenses by 25. Or the inverse, use the 4% rule to make sure that you only need to withdraw 4% per year

- Save 10% of your income for retirement. Or 15%. And the employer match counts. Or it doesn’t.

- When I started saving and investing in the late 90’s and early 2000’s, it was always 10%. Somewhere along the line it bumped to 15%

No wonder people feel like this about financial rules of thumb.

What were some of the responses?

- Penny from She Picks Up Pennies said “I wrote a post about this once. Can’t wait to check out yours! Some are fine, some are total garbage.”

- Felicity from Fetching Financial Freedom says “They’re kind of like BMIs — useful only on a population level / for general frames of reference”

- John from Present Value Finance mentioned “It’s complicated. Everyone’s situation is unique enough that they quickly become meaningless. That said, it’s still better than flying blind!”

- KiwiandKeweenaw said “I like them to initially make a topic more approachable, but they can be limiting!”

- Revenache from A Gai Shan Life had an “Extended thought: I like having them to have a baseline but then I customize almost everything for our lives.”

- And Kong Shi from Kong Template says “I like them for what they are – guidelines. But they should be flexible to adapt to varying circumstances as well.”

P.S. Thanks to @TenaciousFemini & @FrugalishMD for inspiring the poll.

My Thoughts – It’s Complicated

The problem with financial rules of thumb is that since they’re created to try and apply to everyone, they actually apply to no one. The 4% rule at least is based on math and stock market history. But the rest of them are such general guidelines that they’re not very useful.

Personal finance is personal. That’s why you can’t really rely on a rule of thumb, or on the reverse side, get annoyed or frustrated when you don’t meet it. Take it for what it is-a general guideline for a general population-and a starting point. If you don’t meet it because you started saving late/became a doctor and was in residency at 30/were in the military/are disabled/etc., it’s not really the guidelines fault. You just need to understand that it probably doesn’t apply to you, and instead of using a rule of thumb use math.

The only way to really figure out what you need is to actually figure out what you need. What’s your goal, what’s your timeframe for reaching said goal, what do you already have and what more do you need. Then you can form a clear plan how to get there, and adjust the plan based on changes in your goals/life/financial situation as time goes on. Personal finance is personal, but it also changes over time with you and your life circumstances. Plan for and expect adjustments, bumps in the road, and changes in your goals. Those don’t mean you give up, just that you tweak and move on.

What Do You Think?

Do you love financial rules of thumb? Hate them? Or do you also think it’s complicated? Let me know in the comments.

Be sure to follow my blog for more great posts via e-mail or WordPress, or connect with me on Facebook or Twitter and say hello! You can also check out what I’m buying or baking on Instagram, what I’m pinning on Pinterest, or the latest books I’m reading (or want to read) over on Goodreads.

I’m with you… it’s complicated. I tend to enjoy reading about and learning the various “rules of thumb”, but then I have to adjust each one for my own individual circumstances! Personal finance is so personal (obvious, I know.) and needs to be applied to each situation in a different way. So the rules of thumb are great starting points or guidelines to orient thinking, but they are in no way the “be all, end all” rules 🙂

~Mrs. Adventure Rich

I like looking at some of them too, especially earlier in my financial journey to try and see where I should be aiming towards.

Like you, I always got frustrated with Dr. Stanley’s formula, too. Now that we’re older and we can finally say we’re PAW, I like them better. 🙂 I think financial rules of thumb can work a bit like a splinter. Dr. Stanley’s formula was like that for me. It showed me what was possible, and got me mad enough to do something about it. It irritated me enough to change my behavior, even if it wasn’t totally accurate for my situation.

I remember before we even started paying off our debt, reading that the average American had over $10,000 in credit card debt. I realized that we had that much!!! And it made me realize we were stupid. So that was a good thing.

No rule works for 100% of the people 100% of the time (except, perhaps, for death and taxes). But I do find these rules of thumb useful regardless.

Lol, I like his formulas a lot better now too!!!

Oh I kinda treat them as brain teasers! It should be fun and light but I guess when it’s about money…it’s usually not a light subject…

I like to view it from a “let’s hustle it out” mindset. It gives me a boost to find some way to DO better. Not get angry at a poor lady with a viral tweet….

Yeah I don’t understand the anger. When I find a “rule of thumb” that indicates I’m not doing well (like the PAW formula in my 20’s) I don’t get angry at the formula. I do some digging to see what’s underneath it instead.

Nope, wait, stop, hold up.

“So what if you didn’t start working until you completed an advanced degree, served in the military or were disabled? In such cases, you need to deduct those years from your current age when using the Wealth Equation.”

Um, why???

Completing an advanced degree = likely spending more money than you have coming in due to tuition and not being able to hold down a full time, well paying job.

Disabled = may be difficult to work at a full time, well paying job.

Those make sense. I’m okay with including those.

Whyyyyyyyy is serving in the military lumped in there??? Serving in the military (assuming that is your full time job) gives you guaranteed money for housing and food, along with a separate pay for doing your job. The lowest ranking person in the military is earning over $22,000 AFTER accounting for housing. In a very low cost of living location, that means they are earning the equivalent of $30,000, often as a 17- or 18-year-old right out of high school. In my (high cost of living) area, they are getting the equivalent of $42,000. And the raises come quickly. By the time that 17-year-old is 25, they are earning $42,000+ in a low cost of living area, and about $64,000 where I currently live. That’s just the enlisted corps – officers earn more. Not to mention the extensive benefits we get which are worth thousands of dollars each year.

I can accept maybe discounting half of that time to offset the fact that military folks can’t negotiate pay and benefits. But completely ignoring their military time is just another way of perpetuating the myth that military members are paid at poverty levels – a mentality that harms those of us in the military far more than it harms anybody else.

Implying to people in the military that they shouldn’t be concerned about accumulating wealth because, presumably, they aren’t making enough to do so is misleading and dangerous. We have a lot of safeguards other careers don’t have, which

could allow us to save even more money if we can just get it out of our heads that we are poor.

Send any military folks who think they can/should ignore their financial responsibilities during their service my way. I’ll set some truth bombs in their path.

(CMO, I know you didn’t create this thought. My ire is directed at Dr. Stanley, apparently)

Good points Military Dollar. I agree a better approach might be to discount the military years a bit to account for the fact that you had a lower income for some time. I think Dr Stanley’s point was if you’re making $150k per year now (say) but were in the military for 10 years, you don’t need to meet the strict definition of the PAW as written. Simply because your income jumped at a point in time doesn’t mean you always earned that income.

I see a lot of posts criticizing the mainstream financial talking heads. Usually I make one comment, they aren’t talking to you. The reality is financial rules of thumb are not applicable to most of us in the personal finance blogging world. They might not even be applicable to the average person. But they are applicable to the mainstream financial listener and reader. These things are designed to give someone with no financial background the kick in the pants to do something. If it really works they investigate and adapt a personal strategy. Even without though they are better off then doing nothing.

Our readership self selects so they are likely a step up from the person trying their church financial seminar for the first time because their wife/pastor/someone else pushed them. As such we’re not writing to the same audience either.

True. But I know some “average” people find rules of thumb to be discouraging, because they’re so far away from where they “should be” that they just reject it outright. If only there was a way to have a simple “rule of thumb” that was accurate and encouraging at the same time.

Hm. I guess I haven’t given this too much thought. I’m more in the “not so great camp.” There are guiding principles for finances, like “spend less than you earn,” that we could consider rules of thumb, but people’s situations are often so varied that general rules and guidelines don’t work.

True-although I suppose they’re better than nothing.

When I see rules of thumb like this my question is what is the definition of income? Do you include passive income such as dividends and capital gains?

Good questions-sometimes the author of the rule of thumb is clear about that, other times not so much.

Complicated for sure haha.

I also think that we need to realize that as personal finance bloggers we’re weirdos. Like, really big weirdo outcasts. We overthink money compared to the average person which is part of why a lot of these ‘rules of thumb’ don’t make sense to us. For those who just want an easy “tell me what I need to do” type guideline, yeah these aren’t half bad. It’s better than nothing.

But when you really dig into them there’s a LOT more to them…

I think rules of thumb can be a double edged sword. For some, they’re a good place to start or better than nothing. For others, they find it so discouraging they immediately reject it as stupid.

I agree they’re complicated! I enjoy reading them and seeing how I stack up, but don’t always use them as the basis for my financial planning.

I get more frustrated by the rules of thumb that tell how much of your take home pay you should spend on things. (I.e. <30% on housing) How are they calculating take home pay? Is that before or after retirement contributions? What if you want to contribute more to retirement than they think? Etc.

Yeah those rules of thumb about spending as a percentage of income can be dicey. It’s an ok start (like others have mentioned) but your expenses hopefully don’t increase directly in line with your income.

I like the idea of financial “rules of thumb” for most people. However, like you stated there are certain situations that these rules wouldn’t necessarily apply. I think it’s important to understand the assumptions built into these rules, so one can tell whether they should be applicable or not in a specific situation. For example, the “savings as a multiple of income” rule appears to be based on the assumption that one spends people all of their disposable income. While that may be true for most of the population, it doesn’t really apply to us FIRE folks that are saving significant chunks of our after-tax income.

For what it’s worth, “rules of thumb” are common in my branch of engineering – they serve as a quick “go to’s” for initial design idea and “on the floor” equipment troubleshooting, when speed is important. I always tell my new engineers that it’s perfectly fine to seek out and apply these “rules of thumb,” provided that they understand where specifically the rules come from – and to be willing to not follow them if they have a good reason not to. So maybe it’s easy for me to see the financial “rules of thumb” and be OK with the fact that they don’t always apply.

Also, I think this is another one of those situations where we can’t always assume that others are like us. Sure – now that I’ve done a ton of reading (financial books and FIRE blogs), I think I have a good sense of what a good savings rate it and how to allocate investments, etc. And many FIRE people are at a similar level, I’ll bet. But for many, many others, finance is still a mystery. I still remember how clueless I felt when I first graduated and had to decide on savings rates, etc. I felt that there was sooooo much information out there on what to do, and to me it seemed like much of it was confusing and contradictory. I basically got lucky and did the right things early, but that’s not how it works out for many people – my (teacher) wife’s hallway conversations with her peers about 403b’s/457’s have convinced me of that! So if a conservative “rule of thumb” helps prompt people into doing something that’s generally in the right direction, it’s a good thing on balance.

Good points Mr MSW!

Great article – I don’t approve of the #hatemath comment though 🤑

I love doing the math!

I sometimes forget what a bubble I sit in reading/writing in the personal finance space. I made the mistake of challenging a friend (software developer) who said he couldn’t retire in 10 years for all the blah blah blah reasons (kids, don’t want to live like a pauper, deprivation). Limiting beliefs are a huge issue in the US, we are all born with the greatest privilege on earth, being born here with health and the ability to peruse happiness.

In general, I think rules of thumb are good if they are A) Easy to remember, and B) makes me stretch for something that is almost out of reach. If the rule of thumb just tells me I am doing well, I discard it as not being ambitious enough and look for a new one. 🙂

Rules of thumb are a good starting point for anyone that wants to create a financial goal(s). You don’t have to necessarily meet the benchmark of these rules but see it as a ballpark number of where everyone should be at.

I also agree it’s complicated because everyone’s numbers are different, that’s why it’s called personal finance. Not everyone’s goals will have the same number